Company Posts its Ninth Consecutive Quarter of Growth in Services Revenue and MobiKEY Subscribers

Route1 Reports 2016 First Quarter Financial Results

Toronto, May 12, 2016 – Route1 Inc. (TSXV: ROI) (the Company or Route1), a leading provider of secure access technologies for the mobile workspace to protect businesses and government agencies, today announced its first quarter (Q1) financial results for the period ended March 31, 2016.

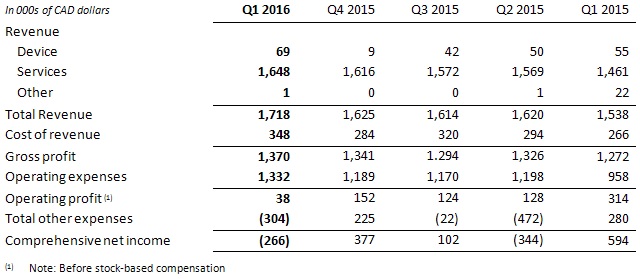

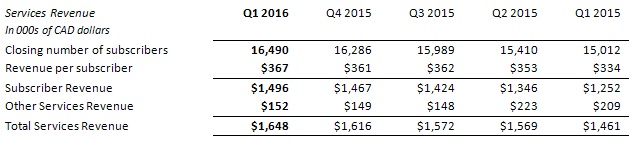

During Q1 2016 Route1 realized further growth in revenue from MobiKEY application software subscribers (recurring revenue). Revenue from services includes MobiKEY application software, as well as the DEFIMNET platform and other appliance licensing or yearly maintenance. The net increase in MobiKEY application software subscribers primarily came from agencies and components within the U.S. Department of Defense, the U.S. Navy, and the U.S. Department of the Interior.

For the noted 16,490 MobiKEY application software subscribers, Route1’s average revenue per subscriber will increase in Q2 2016 to CAD $375 or better as a result of the improved exchange rate realized since renewing certain U.S. government accounts in March and April 2016.

The Company’s operating expenses increased in Q1 2016 by $143k from Q4 2015. Drivers of the difference were a decrease in the Company’s Scientific Research and Experimental Development (SRED) credit available estimate of $112k, and research and development salaries and wages increase of $45k.

During the first quarter of 2016 the Company realized a foreign exchange loss of $177,369. The foreign exchange loss was primarily unrealized ($172,104) and a direct result of the US dollar weakening against the Canadian dollar from a rate of 1.384 on December 31, 2015 to 1.2987 on March 31, 2016.

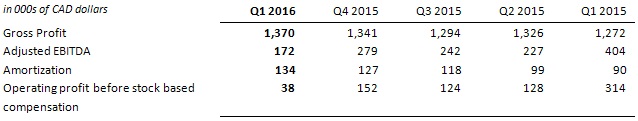

Earnings before interest, tax, depreciation, and amortization (Adjusted EBITDA) during the first quarter of 2016 amounted to approximately $172,000 compared to $404,000 in Q1 2015.

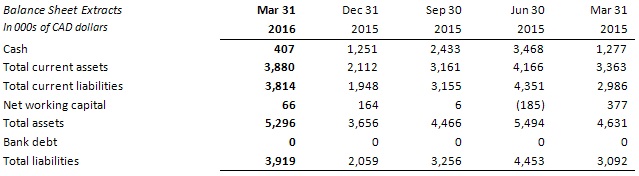

Route1 used cash in operating activities of approximately $0.006 million during Q1 2016 compared with cash generated of $0.452 million in Q1 2015. As at March 31, 2016, the Company had no bank debt and a cash balance of $407,020.

Route1’s cash position is at its highest level during the second quarter of the fiscal year as a direct result of the timing of annual enterprise user subscription renewal payments.

Share Repurchase Program

On September 22, 2015, the Company announced with approval from the TSX Venture Exchange that it had initiated another Normal Course Issuer Bid (NCIB). The NCIB permits the Company to purchase for cancellation up to 5% of the common shares in the public float. The maximum number of shares allowed for repurchase is 18,262,570. Purchases under the NCIB commenced September 27, 2015 and will end September 26, 2016, or the date upon which the maximum number of common shares have been purchased by the Company. As of May 4, 2016 the Company had purchased a total of 7,746,000 common shares under the NCIB.

Since the first NCIB was announced on February 28, 2012, Route1 has repurchased a total of 31,415,200 of its common shares, representing 8.1% of Route1’s common shares outstanding as at February 28, 2012.

As at May 4, 2016, Route1 has 357,505,414 common shares outstanding.

About Route1, Inc.

Route1 enables the mobile workspace without compromising on security. Its flagship technology MobiKEY uniquely combines secure mobile access, with high assurance identity validation and plug-and-play usability. Remote and mobile workers are able to securely and cost-effectively access their workspace from any device without exposing the organization to the risk of data spillage or malware propagation. MobiKEY customers include Fortune 500 enterprises as well as the U.S. Department of Defense, the Department of Homeland Security, the Department of Energy and the Government of Canada. Headquartered in Toronto, Canada, Route1 is listed on the TSX Venture Exchange.

For more information, visit our website at: www.route1.com.

For More Information Contact:

Tony Busseri, CEO

+1 416 814-2635

tony.busseri@route1.com

Skype: Route1CEO

Twitter: @Route1CEO

Facebook: Route1 Inc.

This news release, required by applicable Canadian laws, does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

© Route1 Inc., 2016. All rights reserved. Route1, Route 1, the Route1 and shield design Logo, MobiDESK, Mobi, Route1 MobiVDI, Route1 MobiDESK, Route1 MobiBOOK, Route1 MobiKEY, Route1 MobiNET, IBAD, MobiVDI, MobiNET, DEFIMNET, Powered by MobiNET, Route1 Mobi, Route1 MobiLINK, TruOFFICE, MobiLINK, EnterpriseLIVE, PurLINK, TruCOMMAND, MobiMICRO and MobiKEY are either registered trademarks or trademarks of Route1 Inc. in the United States and/or Canada. All other trademarks and trade names are the property of their respective owners.

The DEFIMNET and MobiNET platforms, the MobiKEY, MobiKEY Classic, MobiKEY Classic 2, MobiKEY Classic 3, MobiKEY Fusion, MobiKEY Fusion2, and MobiKEY Fusion3 devices, and MobiLINK are protected by U.S. Patents 7,814,216, 7,739,726, 9,059,962, 9,059,997 and 9,319,385, Canadian Patent 2,578,053, and other patents pending. The MobiKEY Classic 2 and MobiKEY Classic 3 devices are also protected by U.S. Patents 6,748,541 and 6,763,399, and European Patent 1001329 of Aladdin Knowledge Systems Ltd. and used under license. Other patents are registered or pending in various countries around the world.

Other product and company names mentioned herein may be trademarks of their respective companies.